At The Learning Lab, we encourage our students to learn both inside and beyond the classroom. Skills that will serve young learners well in later life are integrated into various parts of our curriculum.

Of these, perhaps the one with the most practical value is financial literacy, or money sense. It is also one of the skills that you, as a parent, can have the greatest impact in nurturing.

Cultivating good money habits now can help your child to become financially responsible in later years. Take the time to increase his or her understanding of money, earning, spending, saving, and the little details in between.

We recommend parents to find opportunities to explain the bigger financial picture via daily decisions about how to spend time.

For example, going to the movies involves not just the price of the ticket, but also the cost of transport, snacks and drinks. This will make your child more aware of the various aspects of making financial decisions.

Related: 3 Valuable Math Skills Your Child Can Apply In Life

Read on for more ideas about how you can help your child grow into a financially astute adult.

1. Use Everyday Occurrences to Discuss Numbers

This is a scenario that should be familiar to most parents: You are shopping with your child when he or she takes a fancy to a toy, costume or gadget with a price tag of a few hundred dollars.

You weigh your options, but ultimately cannot justify spending that amount of money on something your child has never even expressed an interest in before.

Rather than just telling your child “no”, you can take this opportunity to teach him or her about the value of money. Perhaps you can ask your child what alternative product or activity would keep him or her entertained. You can then compare the prices together and have fun evaluating the numbers.

You can say something like, “This unicorn plushie costs $15. That unicorn rocking horse costs $300. So how many plushies can we buy for $300?”

Putting numbers in perspective helps children grasp the concept of the “operations” — addition, subtraction, multiplication, division and grouping — while learning to look at alternatives. This is an insight we have applied to our maths lessons for Primary 1 students, who learn about how money is used through simple addition and subtraction exercises.

2. Do a “Work Exchange”

Managing the household can be an overwhelming task even when you are a full-time parent. So why not get your child to pitch in by “hiring” him or her to do extra chores?

Make it playful by designating different job titles with different chores and different “salaries”, depending on the work and commitment involved.

You can appoint your preschooler to be the “Overseer of Toys” who helps to put playthings away before bedtime, while older children can be “employed” as “Mealtime Managers” (helping to set the table), “Washing Warriors” (doing the dishes) or “Dust Destroyers” (vacuuming).

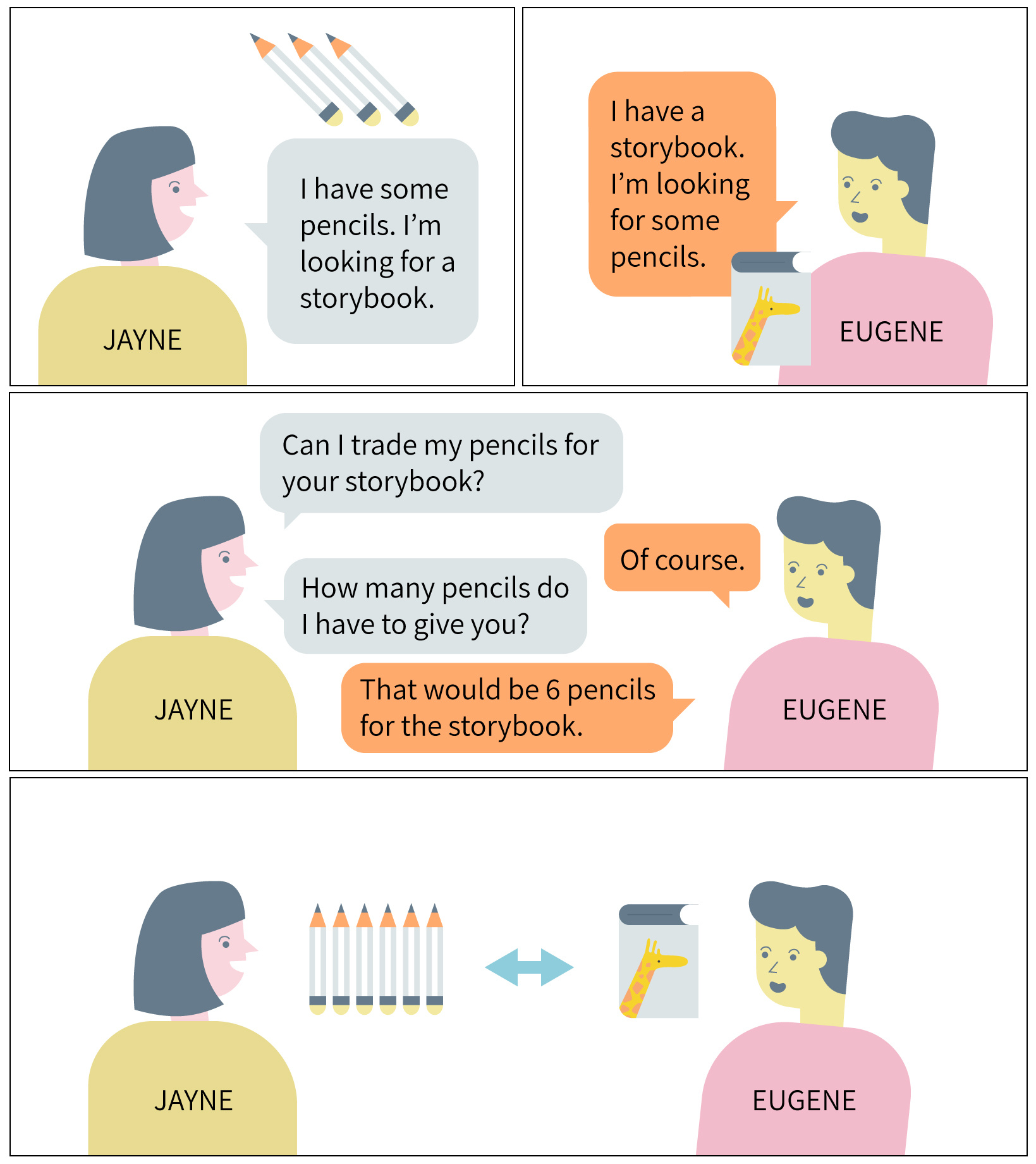

You can choose to pay your child with actual money, or work out a system of barter trade, which our Primary 1 students also learn about in the unit “Making Sense of Money”. In this particular P1 Maths lesson, our students get to learn through a simple comic strip about how in ancient times, the barter system was used before the concept of money was invented. An excerpt from the comic strip is shown below.

Talking about the different types of work that adults do and the different amounts of money that are awarded for each type is a valuable way to raise children’s awareness of ‘earnings.

This exercise will teach your child the value of hard work and responsibility, as well as of earning and saving. Plus, you get to tick off your to-do lists at home faster.

3. Play Treasure Hunt in the Supermarket

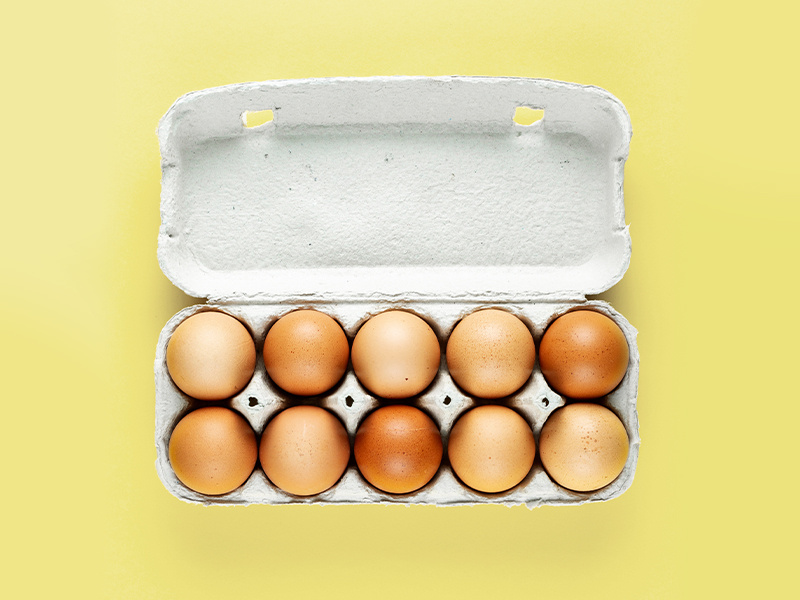

A trip to the supermarket is one of the activities we use to impart the skill of price comparison to our lower primary students. By making a slight adjustment, you can turn your weekly supply run into a learning journey for your young one too.

When you decide to go grocery shopping, set aside a separate list for your child to “hunt” for. Now here is the twist...

Write down the price of the item you want him or her to find and make sure these are actual items you will purchase, so that when they are later used at home, your child can take pride in having picked them himself or herself.

The list could look something like this:

1 carton of 10 eggs

$2.95

Bunch of bananas

$3.95

Bag of long-grain rice (5kg)

$5.80

Clothes hangers (10 per pack)

$4.90

Ask your child to find items with the same price. Do not mention the brand, as the main purpose of this exercise is to give him or her insight into the current cost of goods. It also gives your child the opportunity to make educated choices when shopping.

4. Offer a Weekly Allowance to Teach Daily Budgeting

There are many ways to teach children the art of budgeting. Handing out a weekly allowance can be an effective method for your child to learn. It is up to you to decide the exact amount, though do keep in mind your child’s age, academic needs and maturity.

In lower primary, you might decide to give your child $25 to last him or her the full school week, which means he or she can budget for $5 a day.

You can also set up a reward system where you offer to double what is saved from the allowance after a month, or implement tiered rewards based on the savings targets your child meets. Create a notebook or a “log book” where you can both keep track of the numbers and review them together for fun.

In order to introduce the concept of budgeting to our younger students, our team of maths curriculum specialists came up with an activity booklet where students had to help a cartoon character devise a lunch plan that fit her allowance. You can create similar types of activities for your child to help him or her practise too.

5. Educate Your Child on the Difference Between Needs and Wants

As our society becomes more environmentally conscious, it is also becoming more aware of the damaging consequences of overconsumption. Get your child on board by teaching him or her the difference between needs and wants.

To reduce the motivation for impulse buying when your child gets older, try asking questions that are helpful for self-reflection.

For instance: “Why do you need this right now?” or “What would happen if you do not get this object?”

By going back to the basics and learning to live with only what you need, you are teaching your child to look inwards for happiness and satisfaction rather than accumulating material goods for temporary gratification.

It is also important to reinforce the idea that while your child may not always get what he or she wants, there is always something else to keep him or her going. Through group work and interactive case studies, our lower primary students are taught to make the best out of limited resources and explore alternatives to products that exceed a given budget.

Teaching the Value of Dollars and Sense

Raising financially-savvy kids is vital and it's never too early to start. Building a firm foundation in basic money management and personal financial planning will help to prepare your child for life in the real world. Balancing budgets and calculating expenditure also makes use of numeracy skills that your child has learned in school.

Our Maths programmes that spans across Nursery 2 to Junior College 2 use relatable scenarios and in-class activities to raise your child's awareness of money via real-world contexts from as simple as budgeting for a shopping trip to something as complex as participating in the stock market.

Click here to find out more about our Maths programmes.

The Learning Lab is now at locations. Find a location that suits your needs.

If you have any questions about our range of programmes or class schedules, you may fill in the form below or contact us at 6733 8711 / enquiry@thelearninglab.com.sg.